How to start from zero and build wealth the easy way.

Here are some of the details on Wealth building as a concept and how I think about wealth building. Wealth building is pretty straightforward when you think about it. The hardest thing about amassing a massive fortune is having the discipline to build it and the patience to see it through. Discipline to stick to the plan and the patience to see it to the end. Once you have the plan in place, I find that most people have a hard time just sticking to it because the results come in awfully slow. Everyone wants things to come so quickly so they never achieve anything.

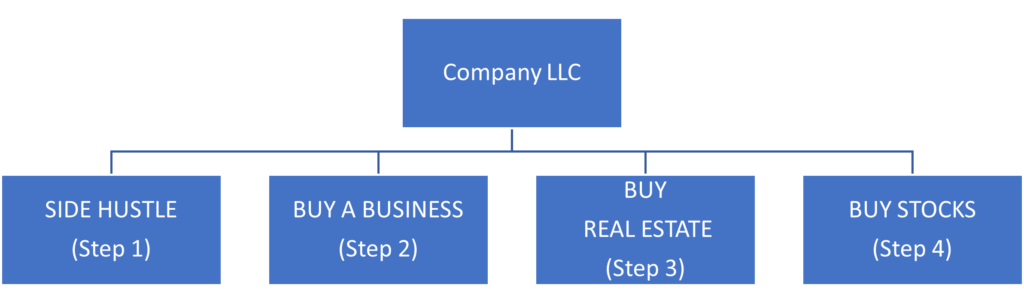

There are 4 ½ steps to building wealth. The half step is forming a legal entity( corporation, LLC, partnership), something to put all of your businesses under. This is your holding company, your umbrella that you will combine everything under. Everything you do will go in here, your different businesses, partnerships, ventures, real estate, etc. Organization, in the beginning, will make things clearer in the long term. You will also need an EIN number to open bank accounts etc. Here the companies I recommend using to incorporate your wealth building machine.

- LegalZoom

- Incorporate.com

- Incfile.com

- Rocketlawyer.com

Now let us get into the meat of the matter. You will be starting a company that will hold all of your future assets and funds all of your future investments. We need to get the holding company to a certain point before inertia takes over and the tiny little company that we have been babying for the two years or so starts to smoke and turn into a baby fire. Now it is time to fan the flames with larger and larger investments to really get this thing going. Remember we are going over the concept here, so you have a basic understanding of what needs to be done to get the level of income you are looking for. Once you understand the theory (concept) we can do a deep dive into what the work actually looks like and how long this will take. If you cannot dedicate multiple years to this then you need to think about the goals you are trying to achieve or have a lot of cash basically ready to go to move directly into steps 2 and 3 and 4. That’s it. Here are the buckets you will divide your funds into.

Side Hustle (Step 1)

We start at the infamous side hustle. Why you may ask, a lot of people do not have the funds to jump right into the other three areas that you will need to build, so this is a great starting point. It will get you in the right mindset and allow you to start really focusing on what you want to do. The side hustle is part of that discipline that you need to have. I do not want you to get overwhelmed with what you are doing. Remember the idea is to be able to continue moving forward in the process and actually make progress instead of getting stuck and frustrated trying to do something that is just a tad too difficult for you to grasp right away. If you are already working a side hustle, you know exactly what I am talking about. The end goal here is to get you to start making additional income that you can save up to move onto the next step which is buying a business(es). Things will start to get complicated extremely fast so having a good grasp on your side hustle is definitely key here. Your side hustle should be on autopilot and it doesn’t take up too much of your time so you can move onto the next step. I have listed a few side hustles or ways to generate income in another article that will help you in this step. Having one bank account where your deposits and withdrawals come from will help you keep track of things. Remember organization, in the beginning, is key!

Buy Businesses Online and Offline (Step 2)

The next step in the process is to buy multiple businesses either online or offline. Online businesses are a bit easier to manage as you can do most of the work yourself. You can also purchase brick/mortar businesses that generate income. The goal here is to start generating income as quickly as possible so you can start to stabilize the amount of revenue that you receive from your side hustle. Once the income from the side hustle is stabilized by the businesses that you are purchasing, you need to reduce expenses as much as you can and reinvest the cash that your business(es) is/are producing so that it can grow quickly. This step is crucial. This is where you can spend a few years buying larger and larger businesses before moving onto step three. Smaller businesses still give cash flow but really getting the steps going will dictate how quickly you can live the life of your dreams.

Here you go:

How to manage multiple businesses

Real Estate (Step 3)

The next step is investing in real estate. This is the goal here! Trying to gather as many units as quickly as possible. In order to do this, you need to have the 1st two steps set up and running well. The side hustle has to take a back seat and the business or businesses that you invested in are generating the profit that you are looking for. Once you have a set amount of income coming in it is time to purchase the property. You are looking for 3-to-4-unit buildings to start with. If you have a lot more cash, you can go larger. Starting with smaller buildings will allow you to get acclimated to being a landlord and understand the process better. You also will put less money on the line if you run into trouble. Having more than 1 unit will allow you to spread the risk of not being able to afford the mortgage amongst more people. Having a 4 unit building with one missing tenant is better than having a 2 unit building missing one tenant. Hopefully, this still allows you to generate a profit. This is the hardest step to get done. the goal here is to accumulate 15 to 20 units. With the average rent being $784, that is approximately 11k to 15k gross coming in every single month. In some places, the rents are definitely higher, and you will be able to generate more income, remember this is an average across the United States. Because of covid-19, the numbers are screwed to the downside and owners are not raising rents to keep tenants. You should be profiting after all expenses roughly 5k per month depending on how much you put down (down payment) and other expenses. Now that you have passive income coming in, the next step is to move on to investing that money into dividend-paying stocks.

Dividend Paying Stocks

Dividend-paying stocks. What you are looking for is a consistent investment strategy where you will continue to put money to work monthly. The goal here is not to try to maximize the price at which you are purchasing stock (getting the stock price cheaply) but to become consistent and disciplined enough to invest the money in stocks when the prices are cheap and when they are not. We are investing for dividends, not price appreciation. Price appreciation is nice, but the goal is to build a portfolio that generates funds that you can live on and put to work as well. The name of the game here is to identify the stocks that pay monthly and quarterly so you will always have funds coming in.

The idea is to run through the whole process at least once so you can see the potential. Now that you have made it to the end with dividend-paying stocks, you can start anywhere in the chain where the opportunity lies. The goal for the 1st time is to get you through the process. Once you go through the entire process once you can dictate where you want to focus your efforts. I would consider dropping the side hustle as soon as possible after you got a few businesses under your belt that make money and focus on buying businesses, real estate and using the profits from both to invest in the market and live on the passive income from stocks.

There you have it! It is a basic four step process that will get you to the finish line. Just take one step at a time and you will definitely be on your way to building massive wealth. The key here is to do one thing at a time and add on new things extremely slowly. Once you have a rhythm that you can maintain between investing and building your business. These things can stop taking up so much of your time! I’ll dive into each step later on and really get into so there is no confusion or questions on how to set this up and get it done!